The Basis Trade on Derive

TLDR

Savvy traders are earning superhuman yields basis trading on Derive:

- The basis trade is the godfather of non-directional, interest-bearing crypto trading strategies

- Basis trading yields are the most bountiful in bull markets

- Traders are currently earning ~$5 in DRV rewards per $1 in fees paid

- You can farm basis yield and earn rewards on Derive right now by depositing wstETH and shorting an equivalent quantity of ETH perps

What is Basis Trading?

The term basis refers to the difference between the price of a derivative and its underlying asset. In traditional financial markets, this trade is commonly known as a cash-and-carry trade. It entails buying a commodity and shorting its futures contract when the futures contract is trading at a premium. In cryptocurrency markets, the basis is the difference between the price of a perp and its underlying asset (spot price), and establishing a basis trade entails holding a long position in a spot asset and shorting an equivalent quantity of perps for the same asset.

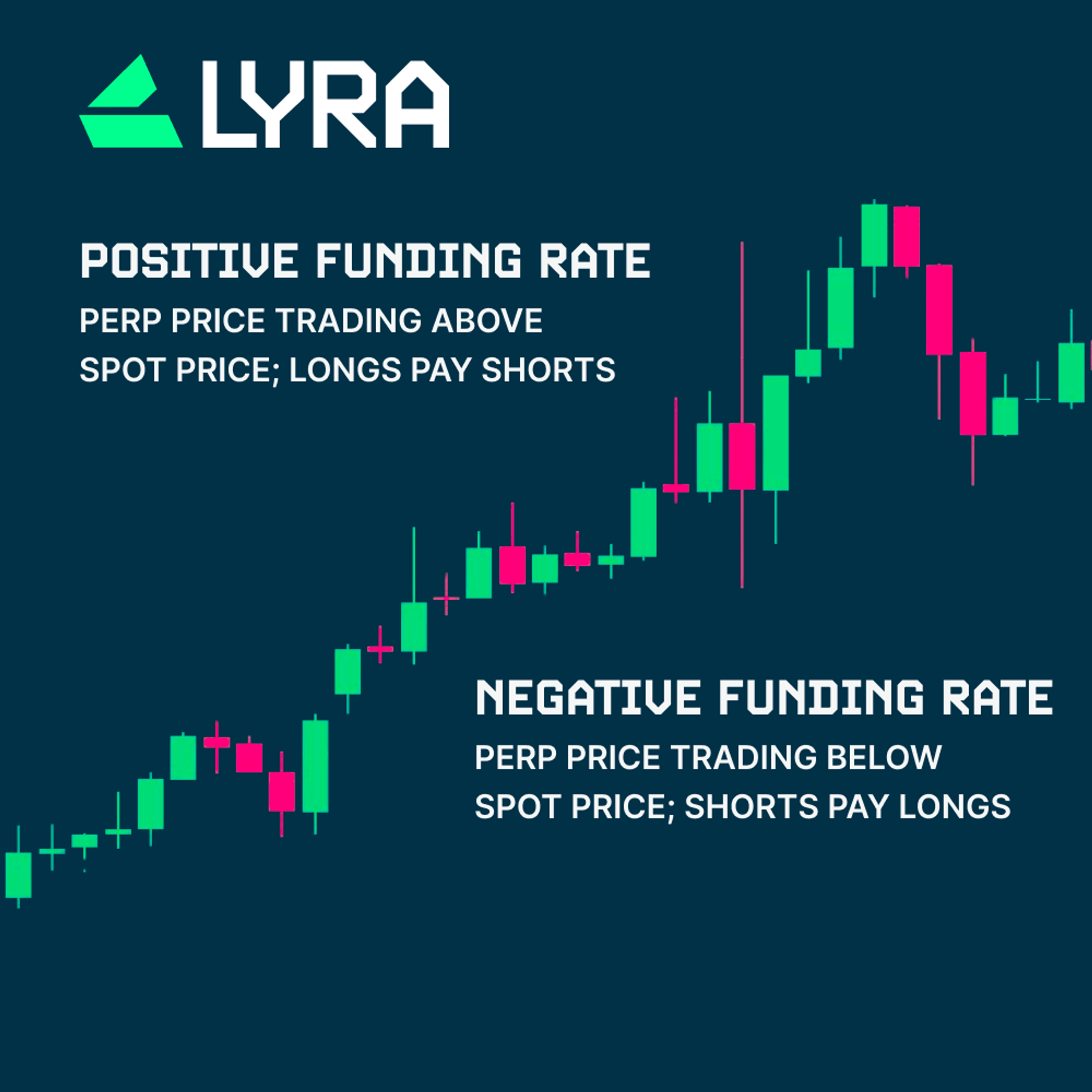

In dated futures markets, price convergence between spot and the futures contract is mediated by time. As the expiration date of the futures contract approaches, its price converges on the spot price. Perpetual futures, as their name suggests, never expire, so an alternative convergence mechanism is needed. Enter funding rates. Funding rates are the mechanism that keeps perp prices closely bound to spot prices, serving to reduce demand imbalances between longs and shorts.

Positive Funding Rates

A positive funding rate environment refers to the market condition in which demand for long perp exposure exceeds the demand for short perp exposure, causing the price of the perp to trade higher than the spot price. When funding rates are positive, perps are trading at a premium relative to spot. In this case, long perp holders pay funding payments to short perp holders.

How much basis traders earn is directly correlated with how high funding rates are. Funding rates tend to remain high during bull markets, as no one wants to throw themselves in front of a freight train by nakedly shorting perps into all-time highs. This is what makes basis trading so special — you get to profit from shorting perps without shorting the market.

Negative Funding Rates

A negative funding rate environment refers to the market condition in which demand for short perp exposure exceeds the demand for long perp exposure, causing the price of the perp to trade below spot price. When funding rates are negative, perps are trading at a discount relative to spot. In this case, short perp holders pay funding payments to long perp holders, reducing, if not eliminating, the viability of basis trading.

Juiced Basis Trading: Simultaneously Collect Funding Payments and Earn Rewards

Barry Bonds hit 73 home runs in 2001, breaking the single-season home run record. How did he do it? Steroids and hand-eye coordination — but mostly steroids. There’s a lesson in there. You can’t hit 73 home runs in a single season without taking steroids, in the same way, you can’t generate the yield available basis trading on Derive right now in the absence of a juiced public rewards program and exceedingly positive funding rates catalyzed by BTC and ETH trading around all-time highs.

Every day your basis trade remains open, you collect funding fees from the short perp leg because longs pay shorts in positive funding rate environments. You will earn DRV on top of your basis trade yield. Since perps don’t expire, you’ll earn DRV again when you close that position.

Basis Trading on Derive Guide

Basis trading on Derive is particularly smooth, thanks to Derive supporting non-USD collateral support. Most DeFi perps exchanges explicitly support USD collateral and would, therefore, preclude you from being able to execute basis trades on one platform. On Derive, basis trading is high-yield and low-effort. You can seamlessly execute a basis trade on Derive in three simple steps. We’ll use an ETH basis trade as an example:

- Step 1: Head to the derive.xyz to deposit 1 wstETH

- However much wstETH you deposit here, you will need to short an equivalent quantity of perps in the next step

- Step 2: Navigate to the perps tab and short 1 ETH perp

- It’s critical to verify that you short the precise quantity of ETH perps you deposited in Step 1

- After completing this step, you are delta-neutral and no longer exposed to the price of ETH

- Step 3: When you’re ready to take profit, or you anticipate funding rates flipping negative, exit the trade by closing your short ETH perp and converting your deposited ETH to USDC

It is also worth noting that you can execute a BTC basis trade on Derive right now by depositing BTC and shorting an equivalent quantity of perps, following the same order of operations outlined in the above example. Whilst the wstETH basis trade is currently the most popular among Derive users, users will ultimately be able to basis trade any asset on Derive that has a perps market and is eligible to be used as collateral.

Strategy Considerations

It is important to remember that funding rates are not constant; they can flip positive or negative in response to fluctuations in demand for long and short-perp exposure. The position becomes less profitable as positive funding rates become less positive, and the strategy is not viable amid negative funding rates.

At the time of writing, basis trading on Derive is yielding ~10-70% APY before factoring in DRV rewards you would earn opening and closing the short perp leg, which are currently approximated at $5 in rewards per $1 in fees paid.

Closing Thoughts

The basis trade is the most liquid and fashionable trade in crypto for good reason — its robustness is derived from its simplicity, lack of directional exposure, and relatively predictable yield. At its core, it is a delta-neutral arbitrage strategy that takes advantage of the differential between spot and perp prices; short perp holders collect funding payments from long perp holders. If there were ever an optimal time to try out a basis trade, it would be right now — during Derive Launch Season in a markedly positive funding rate environment.

Derive is the infrastructure layer for DeFi derivatives, visit derive.xyz.