BTC ETF PVP

TLDR

- The BTC ETF PVP trading competition marks the first phase of the Derive rollout, with the final phase slated for early January. It aims to:

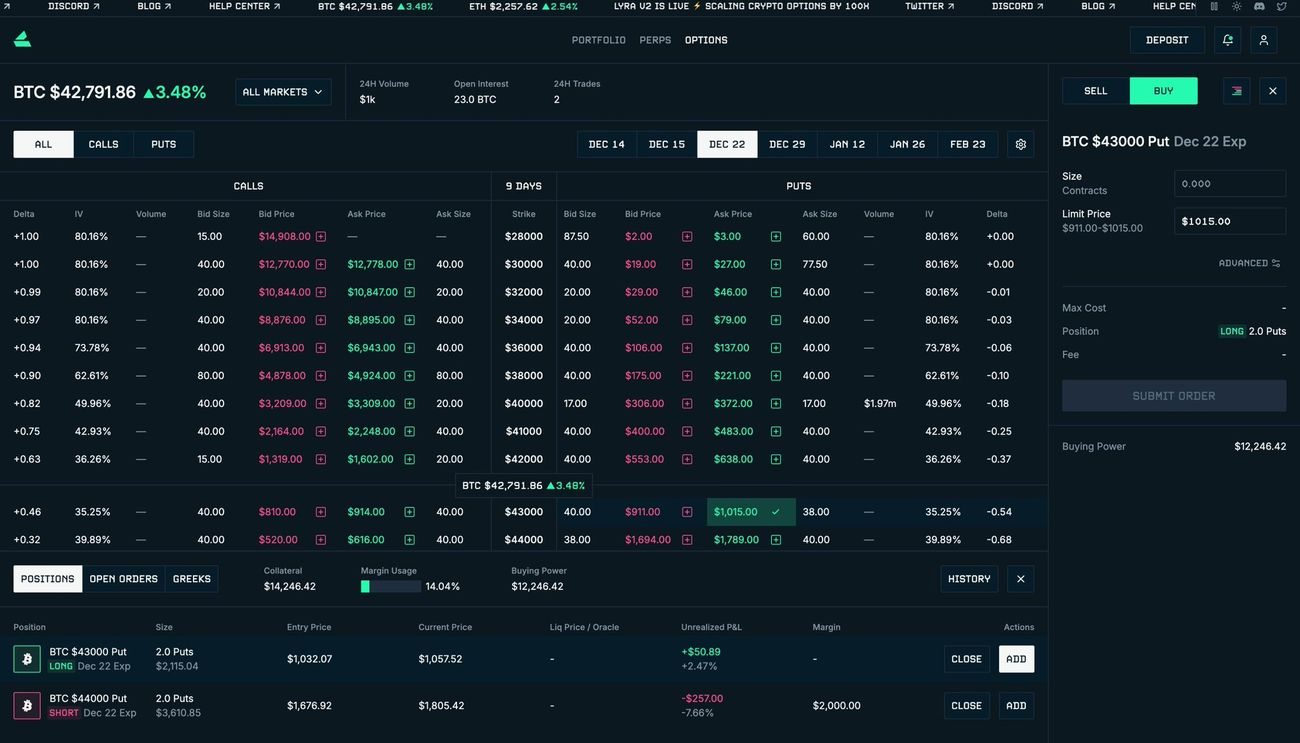

- Concentrate liquidity on a single asset (BTC) and expiry (Jan. 12th)

- Create the highest-ever BTC options OI expiry in DeFi

- Make V2 the most liquid venue to trade the BTC Spot ETF news and witching event

- The competition starts at 2:00 AM UTC on December 15th, 2023

- This coincides with the volatility-inducing Quadruple Witching event

- The competition ends at 8:00 AM UTC on January 12th, 2024

- This is on the heels of the long-awaited BTC Spot ETF approval decision, projected to occur between January 5th and 10th

- Trade the BTC ETF PVP on Derive — full details below

Backdrop

The BTC ETF PVP competition is the red carpet on which Derive will roll out. V2 just veered onto the freeway, and it’s making aggressive lane changes. Buckle up. Crypto assets move fast, but crypto options move even faster. V2 is here and ready for prime time. The BTC ETF PVP coincides with the platform's inauguration, setting the stage for an influx of liquidity and a flurry of volatility. The campaign focuses on one asset, one instrument, and one expiry — the Jan. 12th BTC options market. Stay tuned for a flurry of market alpha. We will be producing high-signal educational content that breaks down Jan. 12th expiry flows, giving you nuanced insights into one of the biggest trading events of the year. We are committed to delivering distinguished educational content that illuminates the circuitry of this year's most significant trading event. Lyra V1 took crypto options from 0-1. Derive will take them from 1-100.

The Calm Before the Storm

The BTC ETF PVP couldn't be more timely, coinciding with the Quadruple Witching on December 15th. This rare event, marked by the simultaneous expiration of stock index futures, stock index options, stock options, and single stock futures, is known to amplify volatility in options markets.

It's this environment of heightened activity, amplified by the impending BTC ETF approval decision, that the BTC ETF PVP seeks to capitalize on — offering traders a unique window of opportunity. Those who can’t take the heat will be forced out of the kitchen, but amid the volatility, one hardened trader will emerge victorious. Earn PVPoints, win DRV. There may be four witches, but there can only be one king.

The BTC Spot ETF Approval Decision

In the backdrop of the BTC ETF PVP, the crypto market is eagerly awaiting the approval decision on the nine Bitcoin ETF applications, each vying for regulatory approval. The approval of any of these ETFs will likely make a huge splash, ushering in a wave of institutional inflows. Blackrock and the other applicants are ready. Are you ready?

The entry of institutional funds into the Bitcoin market through ETFs is anticipated to bring a new level of maturity and stability to the crypto options space. Along with improved liquidity, the influx of smart money would anchor the market, facilitating broader acceptance of Bitcoin as a mainstream financial asset.

The BTC ETF PVP: A Launchpad for Derive

The BTC ETF PVP is not your average trading competition; it's a tactical campaign designed as a booster stage to support launch liquidity in the first phase of Derive’s rollout. You can think of the BTC ETF PVP as a housewarming party, leading you into 2024 — the year we embark on our mission to scale crypto options by 100x. Options CEXes will face a new contender with a unique technical architecture, a full suite of advanced features, and an imposing value proposition. And V2 is ready to deliver the storm — because V2 is the storm. THE STORM PROVIDES ⚡️⛈️🌪️

Competition Details

Start Date

The competition starts at 2:00 AM UTC on December 15th, 2023 — coinciding with the Quadruple Witching, an event that is historically associated with heightened market volatility.

End Date

The competition ends at 8:00 AM UTC on January 12th, 2024 — on the heels of the long-awaited BTC Spot ETF approval decision, projected to occur between January 5th and 10th.

Leaderboard

Your positioning on the leaderboard is determined by your PVPoints. PVPoints are awarded in proportion to your fees paid across our options and perpetuals markets. A 1.2x boost to your points will apply if your realized PNL is in the green (positive) at the end of the competition (i.e. post-expiry).

- PVPoints = 1000 x Fees Paid

How to Win

Trade wisely, earn PVPoints, and win DRV. There are three ways to win:

- 800,000 DRV distributed pro-rata to traders by PVPoints points earned

- 150,000 DRV distributed to the top 3 traders by PVPoints

- 1st place — 80,000 DRV

- 2nd place — 50,000 DRV

- 3rd place — 20,000 DRV

- 50,000 DRV distributed evenly between 5 traders based on mystery mechanics (hint: trade option structures)

- 10,000 DRV awarded to 5 traders, based on trading metrics that will be revealed at the end of the competition (to avoid gaming of the system or inorganic trading activity).

Competition Rules Criteria and Disclaimer

Trading is allowed anytime within the competition window. The competition is open exclusively to participants residing in jurisdictions where they are permitted to engage in trading activities on Derive, in accordance with our terms of use. Participants from restricted jurisdictions, as defined in our terms of use, are not eligible to enter this competition.

Derive is the infrastructure layer for DeFi derivatives, visit derive.xyz.