Derivatives Yield On EigenLayer

TL;DR

- Derive is launching a new primitive to tokenize derivatives yield — any yield-bearing derivatives trade can be automated and packaged up into a composable erc20

- This new primitive will support the dynamic EigenLayer restaking ecosystem, as new AVSs and LRTs create demand for optimal and sustainable yield

- We are starting by tokenizing the basis trade and covered call strategies, allowing users to earn 10-50% APY on their LRTs (rswETH, eETH)

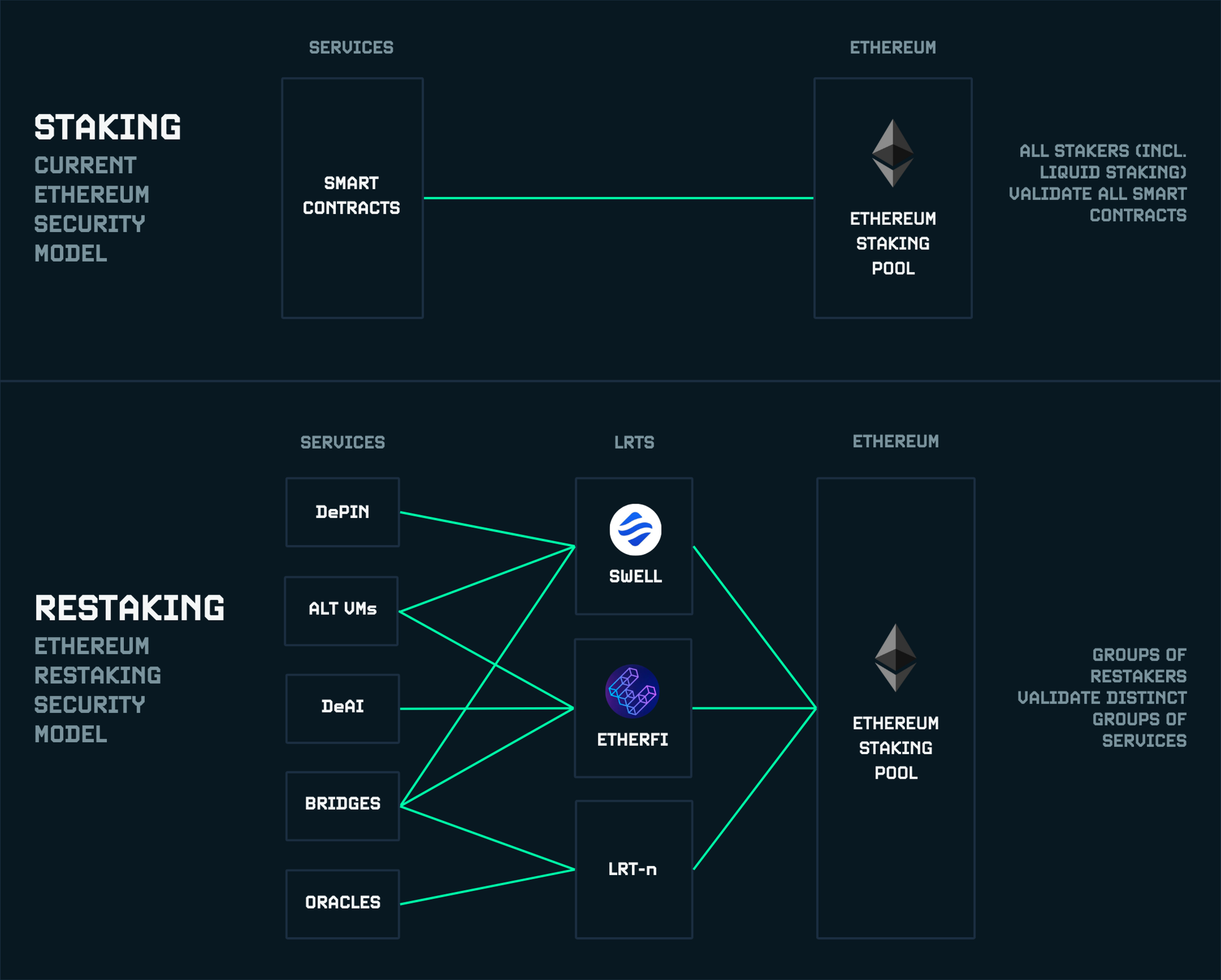

Evolution of Cryptoeconomic Security

Bitcoin’s Proof-of-Work mechanism creates a pool of economic security to secure a single application - the ledger of balances. Ethereum generalized the blockchain with smart contracts, enabling developers to launch many types of applications (DeFi, NFTs, Social) on top of a unified pool of security. Like all commodities, Bitcoin and Ethereum developed structural derivatives markets as miners and stakers seek to hedge costs and maximise yield.

Ethereum’s transition to PoS allowed EigenLayer to introduce restaking, enabling developers to extend economic security beyond the EVM to include bridges, oracles, and eventually the entire internet. Just as Ethereum generalized the blockchain’s application layer, EigenLayer generalizes its security market, transforming a static pool into a two-sided marketplace where restakers (LRTs) rent security to AVSs. Already, EigenLayer has attracted over $15bn in TVL. However, the resulting dynamic is a potentially infinite number of assets with different risk and return profiles—chaos for restakers who want a simplified reward structure. Derivatives solve this problem, transforming volatility into optimal and sustainable yield.

Derivatives Yield

By offering restakers a productive way to put their assets to work — and generate real yield in the process — LRT providers can differentiate and establish network effects in a scalable and performant manner while their networks grow and mature.

There are two sources of yield that every LRT can immediately access:

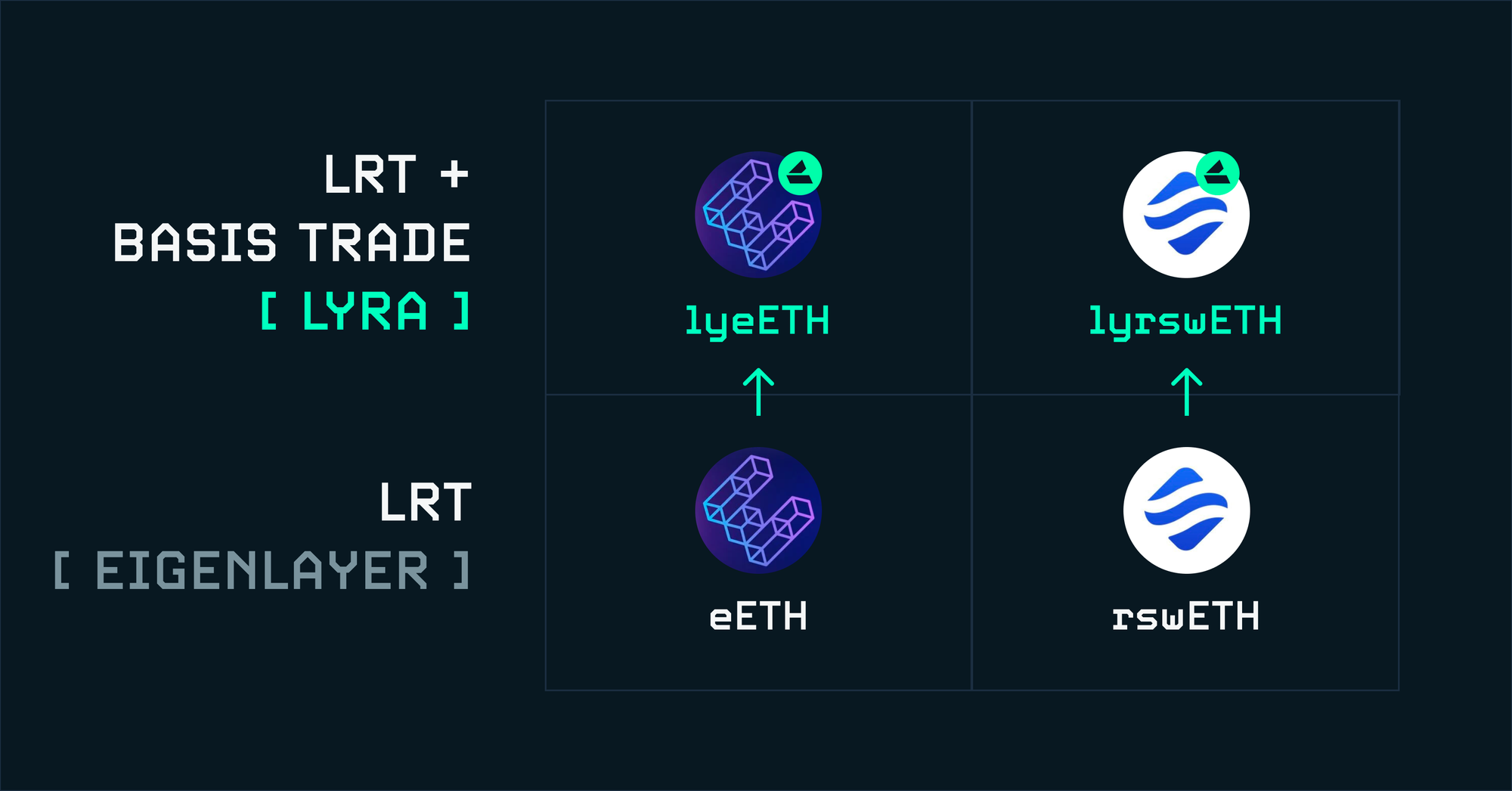

- Basis Trade: Collateralizing the basis trade to harvest funding rate yield (earning a volatile 10-20% APY)

- Options Selling: Selling covered calls & call spreads to harvest volatility (earning 10-50% APY)

The issuance of AVS tokens will increase at an increasing rate as the EigenLayer ecosystem grows. Derive will horizontally scale across this flourishing ecosystem as the new layer of derivatives yield for stakers and re-stakers.

Why Derive can uniquely Tokenize Trades

Derive is the only protocol in DeFi that supports permissionless, onchain settlement of options and perpetuals together, with cross-margin and cross-asset collateral. This unique combination of features makes Derive a yield factory that can forge any yield-bearing derivatives structure (basis trade, covered calls and more) on top of LRTs, and by extension any token.

Strategies like basis trade can be executed manually on Derive today, but there are two issues:

- Complex UX: Executing these strategies is complicated and time-consuming for users

- Composability: Positions and collateral can’t be exported and reused in other DeFi protocols

Evidenced by the success of Ethena and USDe, users want automated execution of yield-bearing strategies on their tokens, and the ability to reuse that liquidity across DeFi.

Enter a new onchain primitive for derivatives yield: the tokenized trading account. By making a Derive trading account fungible, we allow multiple users to deposit collateral and mint a share of the same trading account. In the background, this account executes a predefined strategy transparently and onchain, compounding LPs with real yield in ETH and USDC on their LRT collateral.

For an end-user, they simply deposit their LRTs (eETH, rwsETH) into Derive, and mint a yield-bearing LRT. Similar to USDe, these tokens will be reusable in other protocols and avaiable on multiple chains using Socket’s chain abstraction tech:

- Interest-bearing collateral in DEXs (including the Derive DEX)

- Lending protocols like Aave, Morpho, Ion, Ionic, Gearbox and Juice

- Fixed-yield vault protocols like Pendle, Summer, Notional and Silo

Conclusion

Tokenized derivatives yield is a game-changing primitive that will underpin the bootstrapping of networks and the expansion of sustainable cryptoeconomic markets. We’ll be launching cash and carry and covered call strategies on LRTs and stETH in the coming weeks, with plans to release more products in the future.

And if you made it this far, you deserve an alpha leak: early depositors will be first in line to earn DRV rewards (more info to come soon).

Derive is the infrastructure layer for DeFi derivatives, visit derive.xyz.