One-Click Spreads

TL;DR

- One-click spreads are live on Derive, enabling you to craft any payoff in a single order

- Traders can now comfortably realize profits on in-the-money positions without needing to worry about gaps in liquidity

- Individual leg risk, slippage, and front-running are eliminated, and upfront capital requirements are drastically reduced

- Earn points in our DRV airdrop by trading spreads → https://derive.xyz

Why do users want One-Click Spreads?

Spreads allow for custom payoffs.

Derive traders can now reap the benefits of DeFi’s first feature-complete exchange and only infinite payoff factory. One-click spreads eliminate the risk associated with legging into options strategies one leg at a time by allowing option traders to execute multiple-leg strategies in one click. This has been one of our most, if not our most, requested features to date, and shipping it makes us feature complete, affording us the latitude to concentrate resources on building novel financial tools for the betterment of DeFi as a whole.

When you’re shopping on Amazon and need multiple items, you don’t check out one item at a time. That would be inefficient. Instead, you add all the items you need to your cart and checkout in one swing. The same logic applies to options trading. Rather than assembling a multi-leg spread by placing individually executing trades for each leg of a spread, you can simply add each leg of your desired spread to your trade form and pull the trigger, swiftly executing your trade without needing to cross multiple spreads.

With the addition of multi-leg spreads on Derive, traders can now employ options to explore a world of financial opportunities. One-click spreads on Derive to allow traders to efficiently:

- Sell credit spreads with strictly defined max losses to collect premiums by taking advantage of time decay or overpriced volatility

- Buy debit spreads to significantly reduce upfront premium costs and favorably move up breakeven prices to increase the likelihood of profit

- Swiftly execute delta-neutral, long/short volatility strategies like straddles and strangles

- Open calendar spreads to exploit perceived implied volatility mispricings across the term structure without taking on directional risk

- Trade diagonal spreads to express a bullish or bearish stance on options across different strikes and expirations

- Enter complex, four-legged option strategies like butterflies, condors, and boxes without having to pay excess premiums upfront or post collateral beyond the bare minimum required

How do One-Click Spreads fare on price?

Spreads make options trading more affordable.

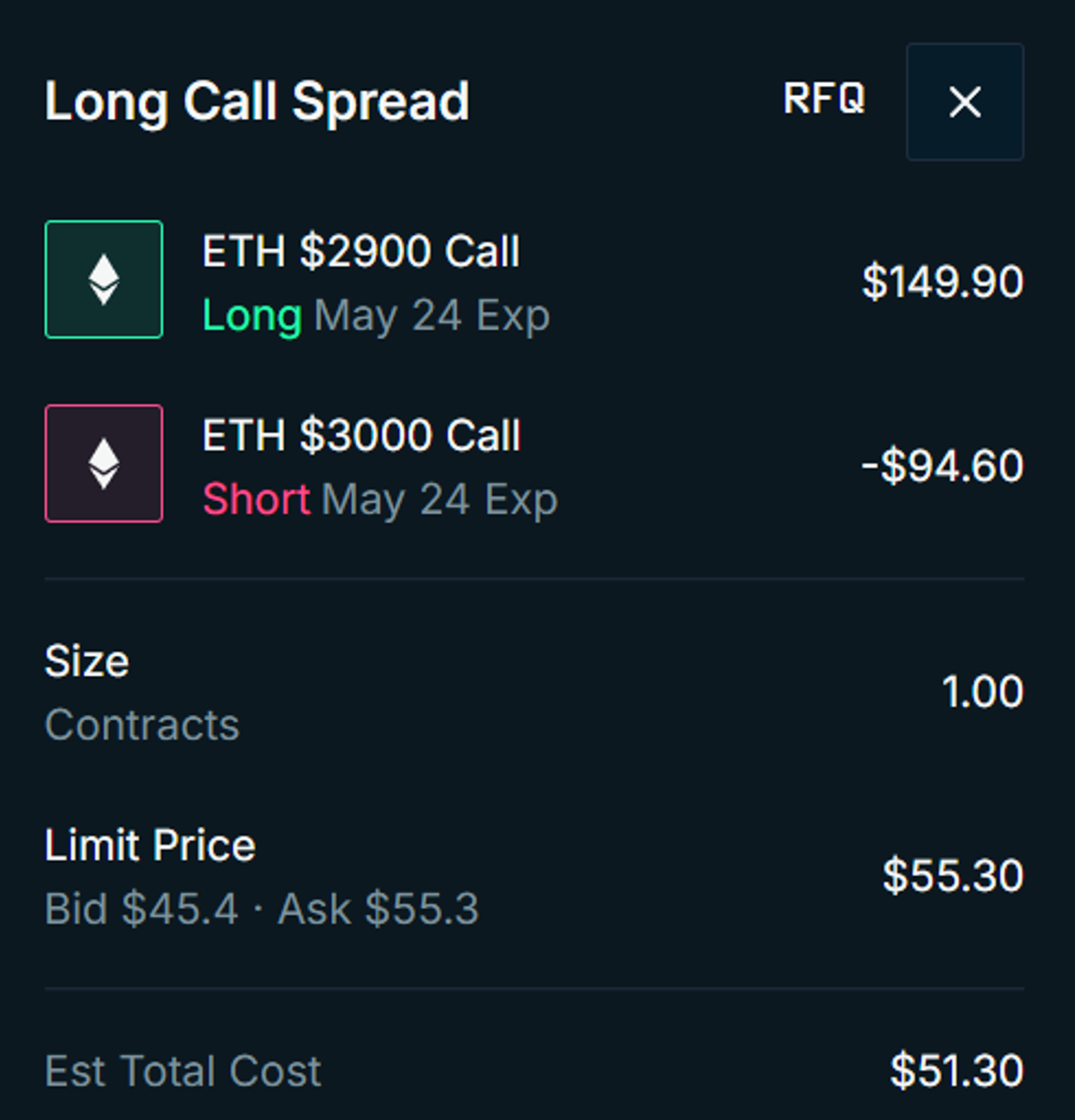

When trading options, executing each leg separately on the orderbook can be costly. Looking at a live example below, typically this spread could cost around $55.30 (at the ask price) for two legs. However, with Derive’s one-click spreads, you only pay $51.30, which is closer to the mid price. This means you save money by paying lower premiums.

Moreover, you only incur fees for a single leg, further reducing your trading costs. Derive’s innovative RFQ system automatically detects spreads, simplifying the process for users. As a result, you only need to cover the total premium for the spread, which streamlines margin requirements and makes them more efficient.

How does liquidity fare with One-Click Spreads?

Spreads allow traders to enter and exit out of positions easily.

One-click spreads enable complex option structures to be traded as single instruments, enhancing interest in specific strikes and expiries even in low-liquidity environments. Efficiently entering and exiting positions on-demand leads to massive cost and convenience savings, addressing the historical challenges of DeFi options protocols such as inefficient margining, mediocre user experiences, and patchy liquidity.

For example, many trades start out-of-the-money and move in-the-money as they are held, and Derive’s RFQ system significantly bolsters in-the-money liquidity by providing targeted liquidity, eliminating slippage, and preventing partial fills. This results in price certainty and a streamlined settlement process, allowing traders to comfortably realize profits on in-the-money positions.

What’s Next for Derive?

One-click spreads marks a pivotal moment for Derive, paving the way for the creation of infinite structured products. As such, Derive is shifting focus to its new line of products; tokenizing derivatives yield. These tokens will unlock permissionless execution of options and perpetuals strategies. This supports the dynamic EigenLayer restaking ecosystem, creating demand for optimal and sustainable yield. Alongside one-click spreads, Derive is nuclearizing the way traders execute complex multi-leg option trades, reducing costs and risks while ensuring 24/7 liquidity, and positioning Derive as a central hub for crypto and financial activity.

Derive is the infrastructure layer for DeFi derivatives, visit derive.xyz.