Yield for Digital Gold & Oil: Automated Basis Trades

The Idea

Bitcoin is often called digital gold, and Ethereum is digital oil; fundamental assets that underpin the crypto economy. But for many, BTC and ETH just sit idle, missing out on opportunities to generate yield.

In 2023/24, basis trading and LSTs surged in popularity, proving that delta-neutral strategies could deliver sustainable yield. Now, with LRTs and automated execution, the approach is evolving—unlocking new layers of efficiency and yield in DeFi. The Basis Trade Vaults take this further by combining idle LSTs/LRTs with staking rewards and a delta = 1 basis trade. Unlike traditional basis strategies that hedge out price movements, these vaults keep full exposure to BTC and ETH, meaning you still benefit from price appreciation while earning yield from funding spreads.

The Strategy

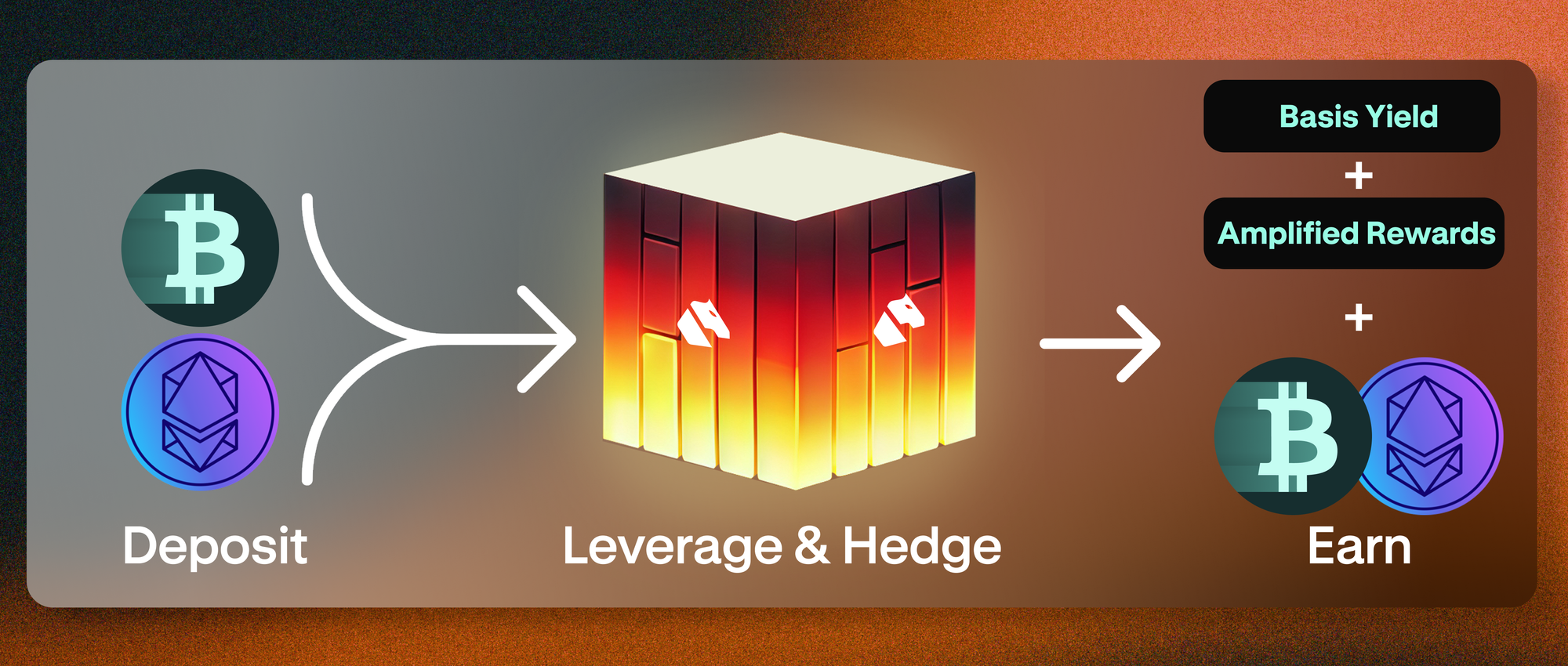

A basis trade exploits the difference between spot and perpetual futures markets. The mechanics are simple:

- Deposit. Supply LBTC or weETH as collateral.

- Leverage & Hedge. Borrow stablecoins, buy more LBTC/weETH (Derive speciality), and short perps to lock in the basis spread.

- Earn. Capture funding spreads, staking rewards, and amplified points from atomic execution.

This approach optimizes capital efficiency, stacking multiple sources of yield while minimizing directional exposure.

The Risks

- What if the market moves against me?The strategy stays hedged. Holding 2 LBTC or weETH against a $100k debt remains safe even if BTC/ETH 100x’s or drops 90%. Gains on one leg offset losses on the other; price is a non-issue. The only pricing risk is a depeg.

- What if funding flips or borrowing costs spike?If perp funding turns negative or stablecoin borrow rates rise, the system automatically reduces leverage to avoid prolonged negative carry.

- Are there any liquidity risks? In cases of low spot or perp liquidity, the vault may take longer to exit positions, potentially resulting in brief periods of negative funding.

Risk Parameters

Automated risk controls ensure stability and efficiency:

- Liquidation Protection. Maintaining balanced collateral-to-debt ratios mitigates extreme price swings.

- Leverage Bounds. The vault dynamically adjusts leverage between predefined limits (e.g., 0.8–3.0).

- Delta Targeting. Positions remain close to neutral to minimize directional exposure.

- Mark-Loss EMA. Monitors trade execution slippage and enforces limits.

- Price Checks. Avoids executing trades on outlier prices.

Trades or withdrawals pause if parameters go out of range, forcing the vault to rebalance before continuing.

The Yield

- Perp Funding (10-20%) – Borrow Rate (5-10%) = Basis Yield

- LBTC & weETH Staking + Points = Additional APR

- Compounded, this turns idle BTC & ETH into a more efficient yield engine.

Compounded, this turns idle BTC & ETH into a more efficient yield engine.

Basis trading has long been a staple in TradFi, generating steady, predictable returns by capturing spreads between spot and futures markets. Now, with yield-bearing collateral like LSTs and LRTs, the strategy is being optimized for DeFi.

Institutions are taking note. As the market matures, structured, delta = 1 strategies are moving from niche to necessity. The Basis Trade Vaults are set to launch in March.